Economic Context

Introduction of Armenia's General Economy

Following the collapse of the USSR, Armenia has gradually worked to build a market economy. However, despite the Law On Protection of Economic Competition, many experts argue that Armenia's economy is not fully free market. Significant state participation in various enterprises and sectors, monopolistic practices in certain areas, weak small and medium enterprises (SMEs), and corruption risks all contribute to this assessment. Given these conditions, Armenia's economic model is best characterized as a mixed economy. Since 2015, Armenia has been an official member of the Eurasian Economic Union, operating under the union's normative legal framework for customs and tariff regulations.

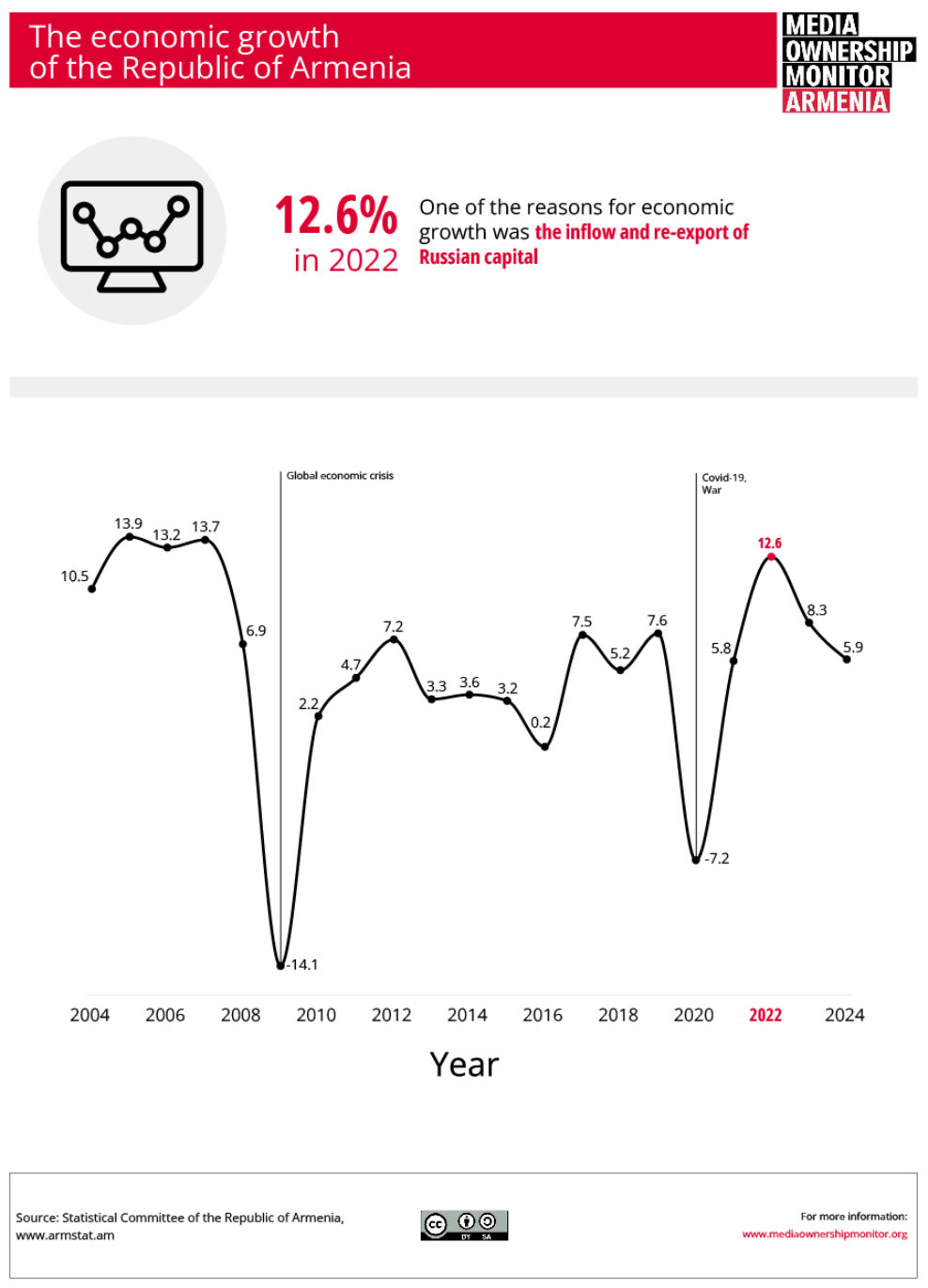

According to the Statistical Committee, Armenia's GDP growth in 2024 was 5.9%. This represents a continued slowdown from the double-digit growth recorded in 2022. Armenia's highest annual economic growth since 2009 was achieved in 2022 at 12.6%. The exceptional 2022 performance was largely driven by the Russian-Ukrainian war, which brought significant flows of people and capital from Russia to Armenia. According to economists and economic officials, Armenia has now returned to its natural growth trajectory following the previous year's extraordinary circumstances.

Trade and services currently drive Armenia's economy, accounting for 5 percentage points of the 5.9% growth recorded in 2024.

Manufacturing industry shows limited growth and contributes minimally to overall economic expansion. The construction sector, while experiencing visible volume increases, remains significantly behind trade and services in terms of economic weight and growth contribution. Agriculture continues to expand at a very slow pace.

Armenia's gross domestic product at market prices reached approximately 10.2 trillion drams in 2024. This translates to a per capita GDP of 3.4 million drams or USD 8,500 annually. The World Bank also publishes this data.

Public Debt

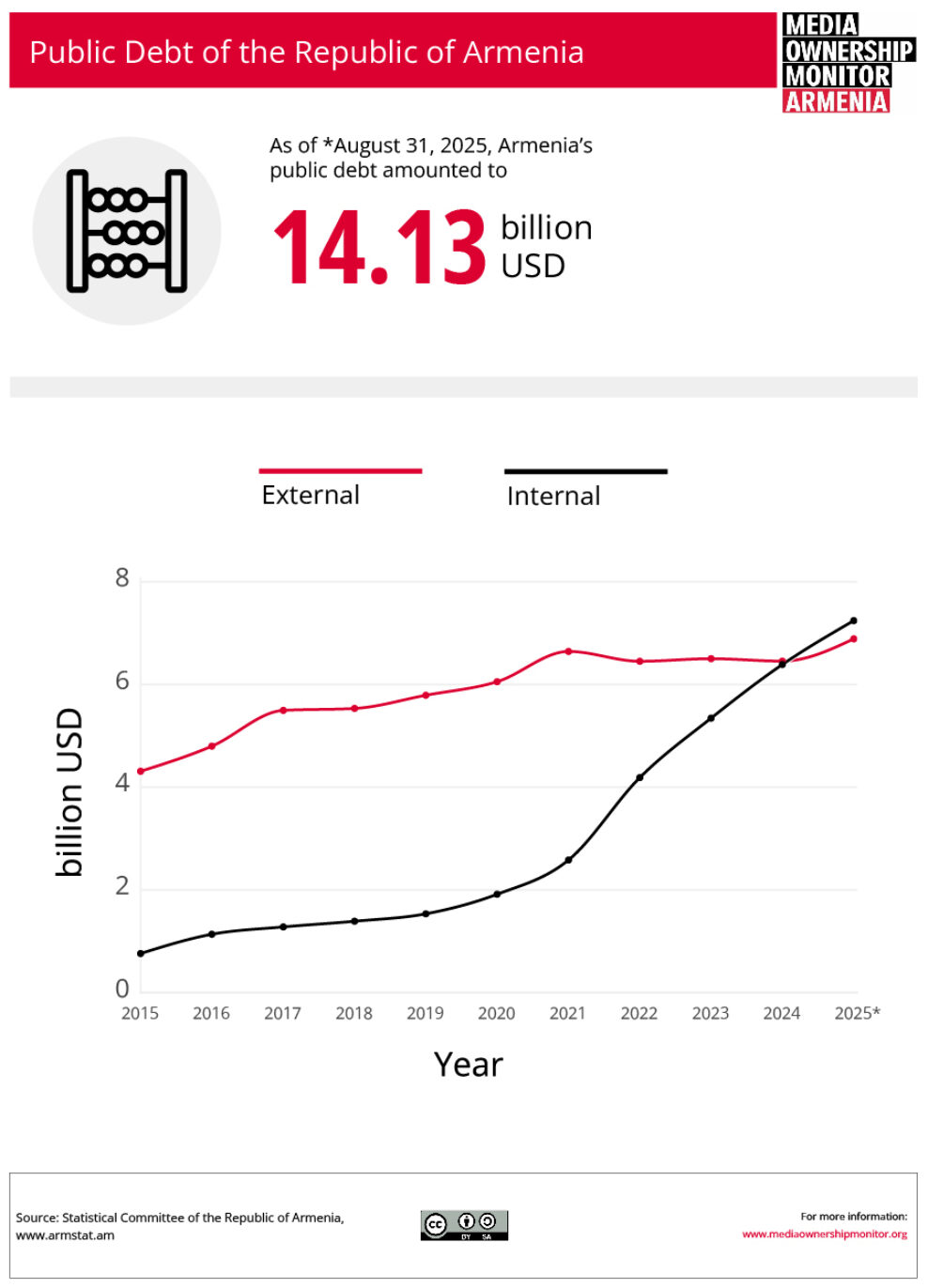

As of December 2024, Armenia's total public debt—combining domestic and external obligations—stands at USD 12.84 billion. This breaks down to USD 6.45 billion in external debt and USD 6.39 billion in domestic debt. Over the course of 2024, total public debt grew by approximately USD 997 million, representing an 8.4% increase driven primarily by domestic borrowing.

Armenia's external debt consists mainly of loans from foreign governments and international organizations, as well as proceeds from Eurobond issuances. The country's debt trajectory has been consistently upward over recent years.

While fiscal regulations indicate that current debt levels remain manageable with no immediate default risk, the growing burden places increasing pressure on public finances. Debt servicing costs—ultimately borne by taxpayers through the state budget—continue to rise as obligations expand.

Unemployment

According to official data, the unemployment rate in Armenia in 2024 was 13.9%. Compared to the previous year, it increased by 1.5 percentage points. The average monthly nominal wage, which is the so-called gross wage and includes taxes, was AMD 287 thousand (USD 750), growing by 6.4% compared to the previous year. The three highest-paying sectors in Armenia are finance, information and communication, and gambling.

Organizational Forms of Media

Armenia's media landscape is shaped by several types of founders: the state (represented by the Public Broadcaster), large businessmen or oligarchs with political connections, political parties and figures, individual officials who use their media outlets as tools in domestic political processes, independent journalists, and public organizations.

Big business and the state predominantly control the broadcasting sector—radio and television—while political forces, individual figures, and NGOs more commonly operate in the print and online media sectors.

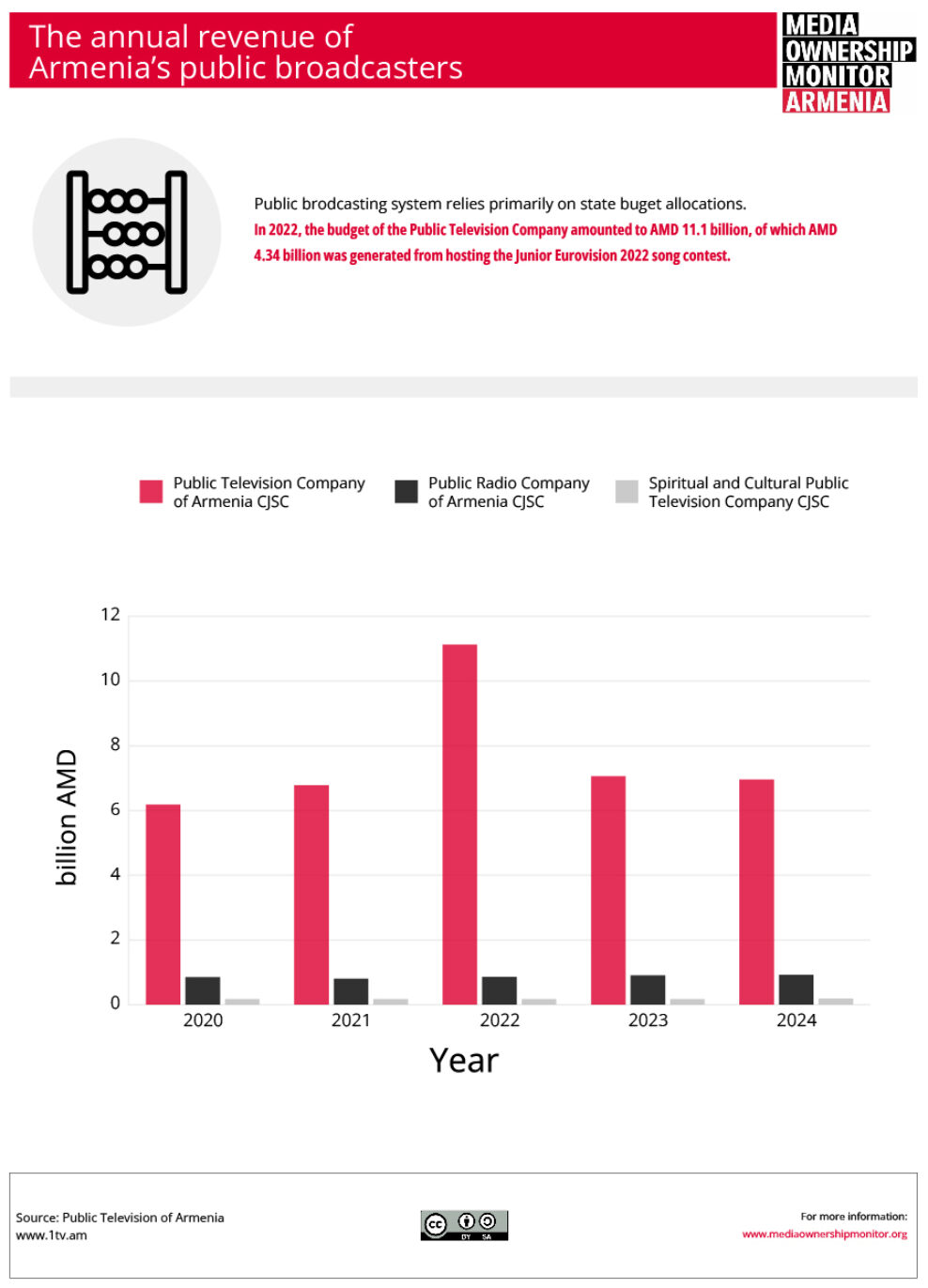

As detailed in our analysis of state-founded media, the government funds the Public Broadcaster, which operates two national television channels (First Channel and First News), one capital city channel (Shogakat), and one radio company (Public Radio of Armenia).

The state also founded and funds the Armenpress news agency with approximately 300 million AMD annually, allocates about 60 million AMD yearly to non-state press, and provides around 280 million AMD to the Armenian national branch of the Mir interstate television and radio company—a CIS-wide broadcasting network serving former Soviet republics. Additionally, support is planned for private television companies through the upcoming Public Benefit Media Environment foundation, which will provide grants to broadcasters licensed to use public multiplex slots for creating public benefit content—including cultural, educational, scientific, children's, sports, and other audiovisual programming. The foundation's grant budget has not yet been disclosed.

Print Media: Struggle for Survival

According to Armen Davtyan, director of the Blitz Media press distribution agency, five years ago about two dozen newspapers were printed in Armenia; in 2025, only 8 remain: Aravot daily, Zhogovurd daily (not printed on Saturdays), Hraparak daily, Past (three times a week), Iravunk (every other day), Azg weekly, Golos Armeniae weekly, and 168 Zham.

The circulation of these newspapers ranges from 1,000-6,000, with newspaper sales averaging 50% according to press distribution agency directors, combining retail and subscription sales.

Previously, there were two main printing houses for newspaper publication: Tigran Mets, which was the largest, and Gind printing houses. In May 2024, Tigran Mets stopped printing newspapers, leaving Gind with a monopoly position in this sector. According to Armen Davtyan, the Director of the press distribution agency Blits Media, as a monopolist, Gind dictates terms to newspapers—requiring printing at least 1,000 copies while knowing that only half are typically sold. The reasoning behind is that lower print runs would increase per-unit costs.

For decades, newspapers were sold for 100 AMD, but in recent years some prices have increased:

- Aravot - AMD 200

- Hraparak - AMD 200

- Jogovurd - AMD 100

- Iravunk - AMD 150 on Friday, AMD 100 on other days

- Past - AMD 150

- Azg - AMD 200

- Golos Armeniae - AMD 250

- 168 Zham - AMD 200

According to Zinc Network's Media Market Analysis research, print media consumption comprises only 3%. The financial and economic situation of this segment is extremely difficult, with newspapers' advertising resources scarce, leading to almost complete digitization of print media and accessibility mainly through the internet and social networks.

According to Armenia's 2024 research on freedom of speech and media consumption, only 0.5% of society considers print media a source for political and social news, and only 17% of all respondents consider Armenian print media a media source.

Previously, four press distribution agencies operated in Armenia—Haymamul, Haypost, Blitz Media, and Press Stand—but currently three remain. Haypost is focused on postal deliveries with newspaper sales being symbolic for the company, Press Stand only does retail sales and has 250 kiosks throughout the republic selling everything from cigarettes to newspapers, and Blitz Media deals exclusively with newspaper and magazine sales.

Armen Davtyan, the Director of Blits Media agency, described the print media situation as hopeless in a conversation with the MOM team. He noted that advertising volume in newspapers is very small, with each publication securing advertisements through their own connections. Besides advertising and sales, a source of income is publishing announcements or notifications, but in July 2025, the Ministry of Justice proposed to the government eliminating the mandatory requirement to publish notifications in media with certain circulation, replacing it with publication on the official website www.azdarar.am. If this change is adopted, print media will also be deprived of this financial source.

Television and Radio

Private television and radio companies are largely connected to big business and politics, (both government and opposition). Their main sources of financing are advertising revenue and founders' investments.

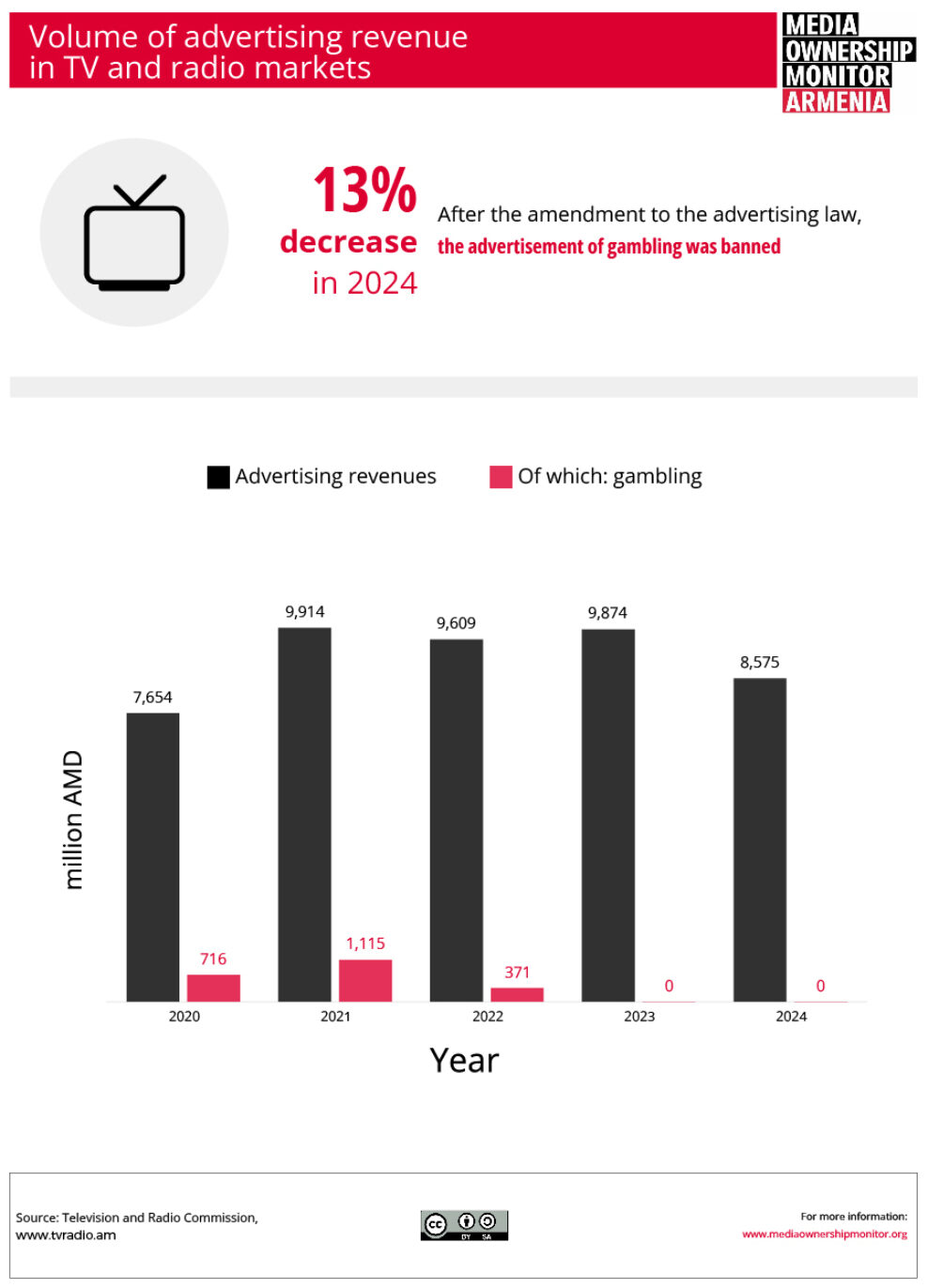

Recent years have seen a significant decline in advertising volumes within the television and radio sector, resulting from changes to the Audiovisual Media and Advertising laws. Key changes include: a ban on gambling advertising, reduced advertising time per hour (from 20 minutes to 14 minutes), and the Public Broadcaster's newly granted right to broadcast advertising starting in 2020. These regulatory changes have created unequal market conditions for private television and radio companies while being financed from the state budget, ultimately reducing their revenues.

Advertising revenue volumes in the television and radio sector over the past 5 years։

Founders' investments have also decreased. Although there is no clear data on this, some television company executives mentioned in conversations with the MOM team that founders or owners are struggling to invest money.

The Armenian online media sector includes two main types of outlets: those established by private legal entities with political affiliations—meaning their content may lack neutrality—and those founded by public organizations. Media outlets tied to public organizations rely primarily on grants from international foundations, though many now seek more diversified income streams. These efforts include attracting advertising revenue, launching subscription models, using social media platform monetization, and engaging audiences through crowdfunding platforms such as Patreon.

According to Zinc Network's 2024 Media Market Analysis, independent media largely rely on external support, with donors as their main supporters. The study concludes: “Although donors play an important role in preserving the independence of Armenian media by providing necessary financial support for various projects and thematic content, the general absence of long-term, strategic institutional support makes these media vulnerable, as their financial stability is often linked to the success of individual initiatives rather than long-term structural support.”

Research on Freedom of Speech and Media Consumption in Armenia reveals that public willingness to fund news media remains low; only 1% of Armenians currently support media financially, and just 17% express readiness to do so—usually only up to about AMD 2,000 (around USD 5) per year. Technical limitations in Armenia’s banking infrastructure also restrict the range of payment systems available, making digital monetization harder for outlets.

Politically affiliated online media are believed to be funded through advertising and founder investments, though many do not disclose financial details. Observers note that the advertisers featured on such sites can sometimes signal their political connections, as business in Armenia remains somewhat politicized.

There is no precise data on the online media advertising market. According to the aforementioned Zinc Network report, it was previously estimated at approximately 60 million USD annually. According to Statista Market Insights company forecasts, advertising spending in Armenia's advertising market is expected to reach 90.45 million USD in 2025.

"The largest market in the country will be television and video advertising, comprising 28.67 million USD in 2025. 62% of total advertising spending in Armenia's advertising market in 2029 is expected to come from digital sources. Per capita advertising spending in the television and video advertising market will be about 10.32 USD in 2025," the company’s study states.

According to the same source, Armenia's advertising market is experiencing a transition toward digital platforms, with increasing attention paid to social networks and influencer marketing strategies. This confirms the view that opinion leaders are "stealing" part of the advertising market from online media, as working with them is cost-effective for advertisers—there's no need to spend money on production; instead, a small amount can be spent on placing advertisements on opinion leaders' social media pages.

This type of advertising can significantly impact the media market. Businesses adapt to changing consumer behavior and preferences, and the growth of advertising through opinion leaders demonstrates the effectiveness of this type of advertising in terms of engaging audiences. At the same time, digital media may face new competition.

Besides growing competition with opinion leaders, other challenges face the media market. In 2022, a law banning gambling advertising on the internet came into effect, which also applies to radio and television advertising. According to News Radio director David Khumaryan, due to this ban, the online advertising market will lose 40% of turnover, radio—30%, and television—approximately 20%. This reduction in advertising market revenues will negatively affect content creation.

In a conversation with Media.am, digital advertising specialist Arsen Sultanian identified the three largest sectors providing advertisements to media: the financial sector (banks, payment methods, applications), telecommunications and communication operators, and the retail trade sector (electronics, construction materials stores, etc.). Media representatives note that opinion leaders create growing competition for advertising revenue from these sectors, as advertisers lose interest in investigative media amid the growth of entertainment websites.

Another source of competition are social media platforms, and advertisers often prefer to approach Facebook or YouTube directly, bypassing the media in this process," the "Media Market Analysis" study notes.