Technology

Market Overview

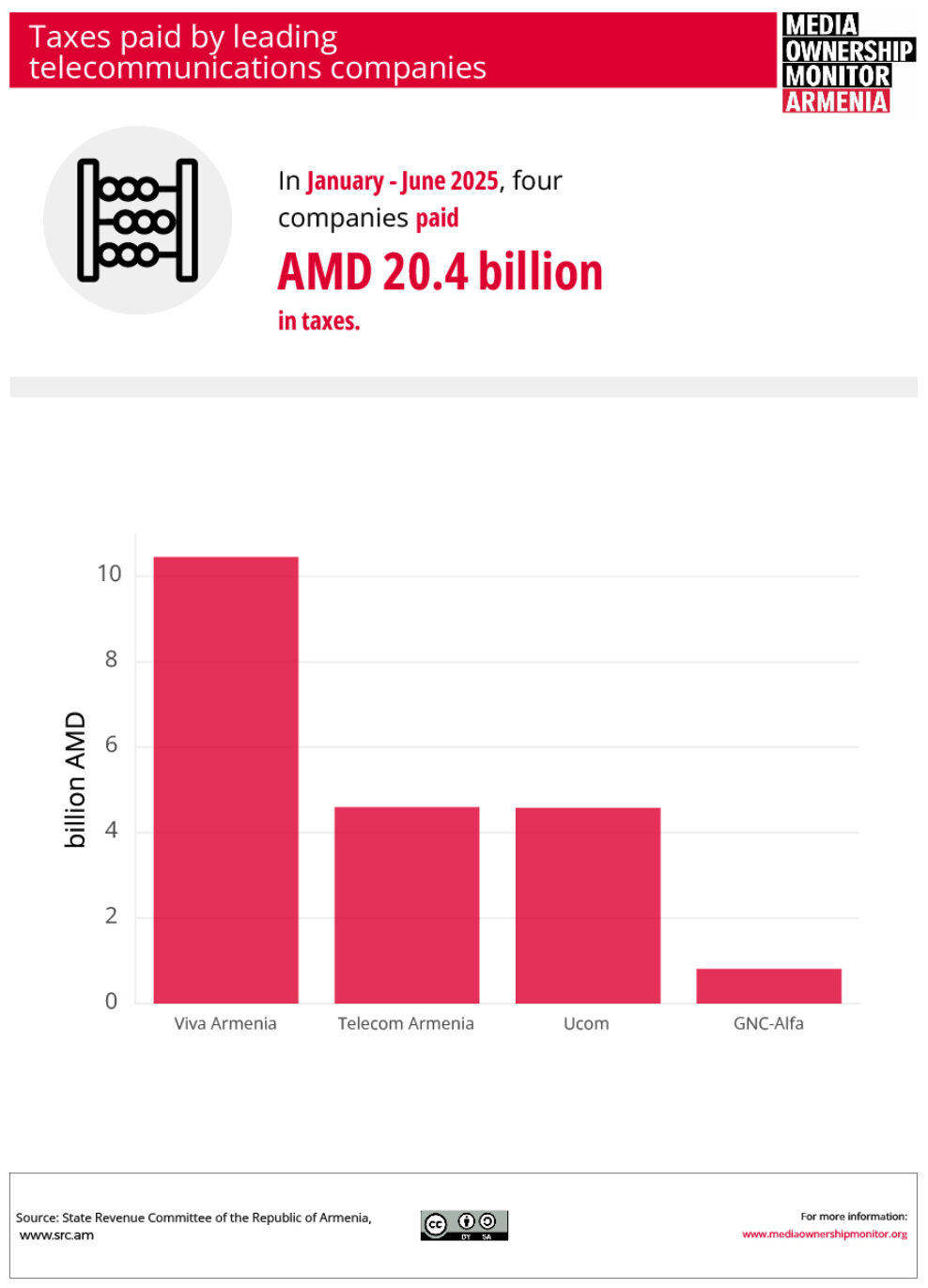

Armenia's telecommunications sector is dominated by four major companies: Viva Armenia CJSC, Telecom Armenia CJSC, Ucom LLC, and GNC-Alfa CJSC. These companies are among Armenia's 1,000 largest taxpayers and collectively paid AMD 20.4 billion (USD 53.3 million, based on the Armenian Central Bank exchange rate as of 10.10.2025) in taxes during January-June 2025. The sector shows a trend toward consolidation, most notably with Viva Armenia's acquisition of GNC-Alfa in July 2025. According to CEIC data, mobile communications revenue reached approximately AMD 41 billion (USD 103.5 million) in 2024. The market is characterized by declining fixed telephony, growing mobile and mobile internet usage, and increasing bundling of services (mobile + fixed internet + IPTV).

Major Telecommunications Companies

Viva Armenia

Viva Armenia (formerly MTS Armenia, originally K-Telecom) is a major mobile operator that entered the market in 2005, ending ArmenTel's approximately ten-year monopoly. The company was a member of the Russian MTS Group from 2007 to 2024 and is a significant taxpayer, contributing AMD 10.5 billion in taxes during January-June 2025.

In July 2025, Armenia’s Competition Protection Commission approved Viva Armenia's acquisition of 100% of GNC-Alfa CJSC shares. This consolidation significantly strengthened Viva Armenia's market position, combining mobile services with GNC-Alfa's extensive fiber optic infrastructure.

Telecom Armenia

Telecom Armenia (formerly VEON Armenia, originally ArmenTel) has operated as one of the main mobile and fixed communications providers since the mid-1990s. As of 2023, the company serves 25.6% of mobile subscribers, representing over one million customers. In January-June 2025, it paid AMD 4.6 billion in taxes. The ultimate beneficial owners are brothers Hayk and Aleksandr Yesayan, who hold a combined 82.5% stake. The Yesayans are former Ucom shareholders.

Ucom

Ucom is a major telecommunications operator offering fixed internet, fixed telephony, and mobile services through local offices and service centers. The company paid AMD 4.6 billion in taxes during January-June 2025.

Ucom is linked to Gagik Khachatryan, Armenia's former Minister of Finance. His eldest son, Gurgen Khachatryan, chairs Ucom's board of directors. Gurgen and his brother Artyom currently face criminal charges, including money laundering, while their father faces charges related to the confiscation of illegally obtained property.

In 2022, U.S. authorities, at Armenian law enforcement's request, petitioned a U.S. court to seize and sell the Khachatryans' Los Angeles mansion. The case was resolved via a settlement in 2024, with the mansion sold and Armenia's Prosecutor General's Office securing an agreement to receive approximately 80% of the proceeds (the original settlement allocated 15% to the Khachatryans and 85% to the U.S. side).

GNC-Alfa (OVIO)

GNC-Alfa was founded in 2007, with the Russian company Rostelekom acquiring a controlling stake in 2012. The company provides broadband internet, fixed telephony, and digital television services through fiber optic infrastructure covering 92% of Armenian cities. In January-June 2025, it paid AMD 809 million in taxes.

In 2024, GNC-Alfa commissioned Armenia's largest data processing and cloud services center, an investment project with government participation. Since 2024, the company has operated under the OVIO brand. In July 2025, Viva Armenia acquired 100% of GNC-Alfa's shares, pending completion of the transaction.

Smaller Providers

Numerous small internet providers and regional operators supplement the four major companies. The market demonstrates clear consolidation trends, with larger players acquiring smaller competitors and expanding service offerings.

Ownership Patterns

Major telecommunications operators demonstrate a mix of local business groups and, historically, foreign investors. Russian MTS controlled what is now Viva Armenia from 2007 to 2024, while international telecommunications company VEON previously owned Telecom Armenia. Russian company Rostelekom held the controlling stake in GNC-Alfa from 2012 until the 2025 Viva Armenia acquisition.

Recent years show a trend of local entrepreneurs purchasing shares and consolidating control. The Yesayan brothers' 82.5% ownership of Telecom Armenia exemplifies this pattern. All major operators maintain physical presence through offices and service centers in Yerevan and provincial regions, along with their own network infrastructure including mobile stations, fiber optic backbone, and international connections.

Regulatory Framework

All telecommunications operators function under licenses issued by the Public Services Regulatory Commission of Armenia. The commission oversees spectrum allocation, enforces consumer rights protection, and monitors service quality reporting. Companies are legally obligated to respond to court orders and lawful government requests for data provision, though the specific protocols and frequency of such requests are not publicly documented.

Telecommunications and Media

Content Distribution

Fixed internet and television service providers function simultaneously as media content distributors. Telecom Armenia and Ucom, two of the three leading telecommunications companies, operate as major network operators carrying media content.

IPTV services represent a key intersection between telecommunications and media. GNC-Alfa (OVIO brand) and Viva Armenia provide IPTV services, though through intermediaries rather than direct broadcasting. Television channel distribution is carried out by Hybrid Solutions LLC, which serves as the intermediary platform.

Operators collaborate with media companies through advertising campaigns, IPTV service bundling, and content exchange agreements. The bundling of mobile communications, fixed internet, and IPTV into combined packages creates direct relationships between telecommunications providers and media consumption patterns.

Digital Media Landscape

The online audience for Armenian media organizations depends primarily on global platforms—Facebook, YouTube, and Instagram. Local telecommunications operators provide network access and connectivity but do not control content algorithms or distribution mechanisms on these platforms. This creates a separation between infrastructure providers (local) and content distribution algorithms (global platforms).

Media monetization occurs through two primary channels: global platform advertising programs (YouTube, Facebook) and local direct sales including IPTV packages and sponsorship programs. Telecommunications companies influence media primarily through infrastructure control and IPTV bundling rather than through content curation or algorithmic distribution.